Business Insurance in and around Portsmouth

Portsmouth! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

- Greenland

- New Castle

- Rye

- Newington

- Dover

- Kittery

- Stratham

- Exeter

- North Hampton

- York

- Hampton

- Seabrook

- Manchester

- New Hampshire

- Maine

State Farm Understands Small Businesses.

Do you own a window treatment store, a camping store or an architect business? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

Portsmouth! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

When one is as committed to their small business as you are, it makes sense to want to make sure everything is in order. That's why State Farm has coverage options for worker’s compensation, commercial auto, surety and fidelity bonds, and more.

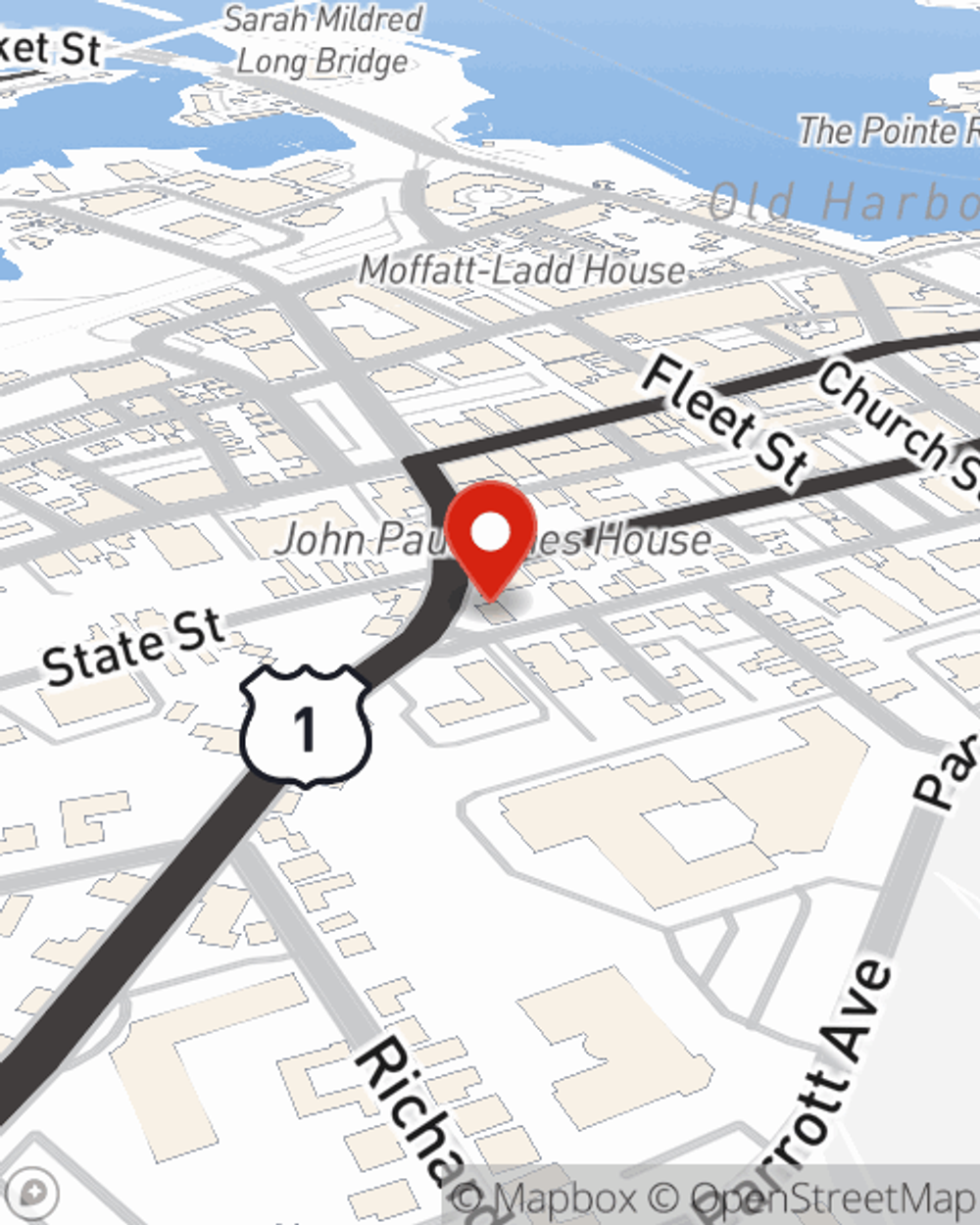

The right coverages can help keep your business safe. Consider visiting State Farm agent Aileen Dugan's office today to discover your options and get started!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Aileen Dugan

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.